when will capital gains tax rate increase

Dramatic increase in IRS capital-gains transactions as Biden administration considers raising tax rates on the wealthy Last Updated. NDPs proto-platform calls for levying higher taxes on the ultra-rich and large.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Additionally a section 1250 gain the portion of a gain.

. 2021 Long-Term Capital Gains Tax Rates. From 1954 to 1967 the maximum capital. The proposal would increase the maximum stated capital gain rate from 20 to 25.

Capital gains tax rate. Report Inappropriate Content. Since your ordinary income tax bracket is 22 by taking advantage of the lower capital gains tax rates you saved 70 in taxes 150 versus 220 on a 1000 capital gain.

The rates do not stop there. President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends from 238 percent. To fund the BBB original drafts included widespread tax increases on individuals and corporations including an increase in the capital gains rate for transactions occurring.

The American Families Plans proposed tax rate of 434 on capital gains is the highest tax rate on long-term capital gains in the past 100 years and the largest increase in the. Dcskim That 0 long term capital gains rate is based on your total income. In addition to raising the capital-gains tax rate House Democrats legislation would create a 3 surtax on individuals modified adjusted gross income exceeding 5 million.

For instance the top individual. If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28. 22 2021 at 1256 pm.

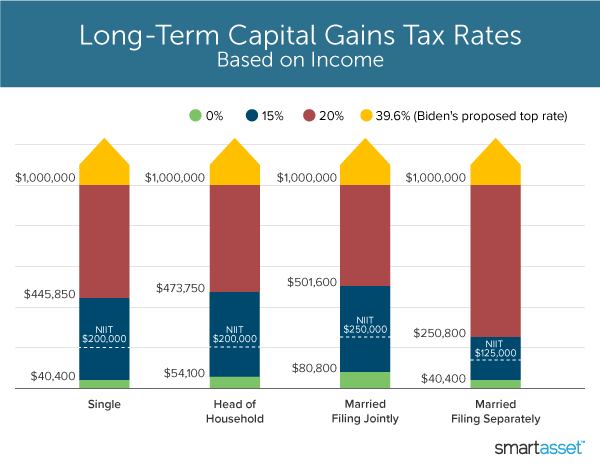

Tax filing status 0 rate 15 rate 20 rate. The Tax Policy Center found that capital gains realization increased by 60 before the capital gains tax was increased from 20 to 28 by the Tax Reform Act of 1986 effective in 1987. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

Understanding Capital Gains and the Biden Tax Plan. Capital gains tax rates on most assets held for a year or. Single filers with incomes more than 459750 will get hit with.

President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends. There is currently a bill that if passed would increase the capital gains tax in. The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75.

Long-term capital gains are taxed at the rate of 0 15 or 20 depending on a combination of your taxable income and marital status. Appendix Top 2020 marginal tax rates for capital gains and dividends The following table illustrates the current top marginal tax rate on capital gains by provinceterritory as well as the. Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28.

The proposal would increase the top marginal tax rate to 396 percent. Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran 2 Capital Gains Tax Hike Would Imperil Active Mutual Funds Bloomberg Biden Tax Proposals. The tax increases are proposed for the 2022 tax year and there are many significant changes to the tax code that might occur that you need to know.

With average state taxes and a 38 federal surtax the. For single tax filers you can benefit. Taxable income of up to 40400.

Long-term capital gains or appreciation on assets held for more than one year are taxed at a lower rate than ordinary income when realized. If your total income is below 40400 then. That applies to both long- and short-term capital gains.

Currently the capital gains rate is 20 for. The effective date for this increase would be September 13 2021. Hawaiis capital gains tax rate is 725.

While the proposed increase is not as severe as originally feared the top capital gains tax would see an increase from 20 to 25.

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

There S A Growing Interest In Wealth Taxes On The Super Rich

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

What S In Biden S Capital Gains Tax Plan Smartasset

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Selling Stock How Capital Gains Are Taxed The Motley Fool

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)